Table of Contents

- Chart: U.S. - China Trade Tariffs Are Reaching Their Limit | Statista

- Section 301 Tariff Updates: USTR Grants Exclusions & Seeks Comments on ...

- China Tariff Cuts: Expert: We are not at a trade war at the moment - CGTN

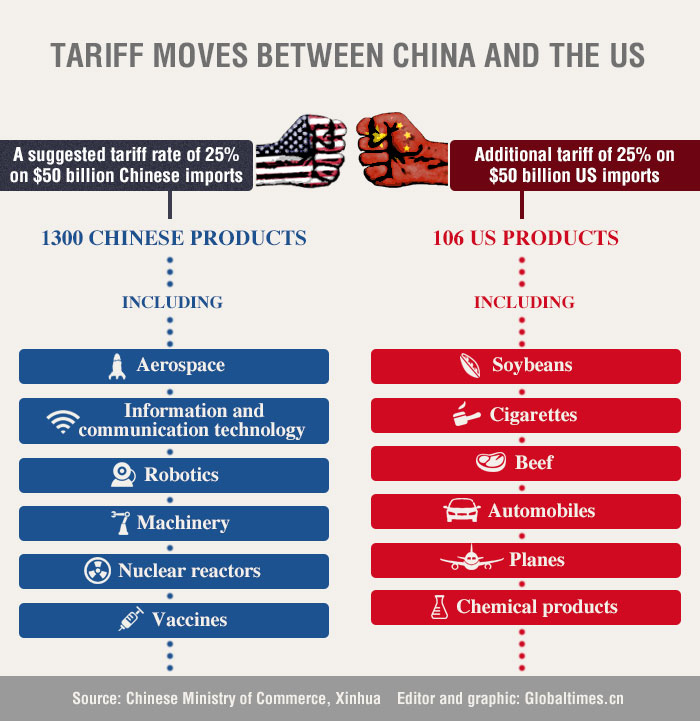

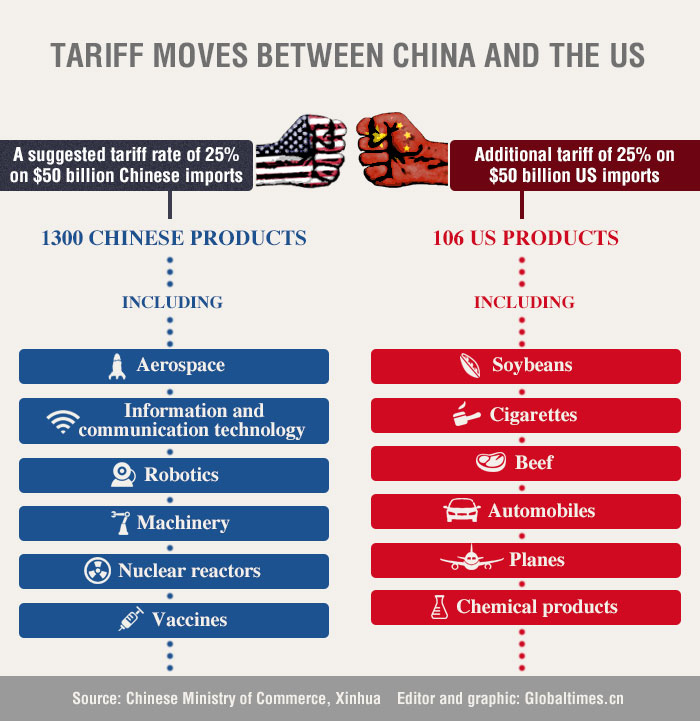

- Tariff moves between China and the US - Global Times

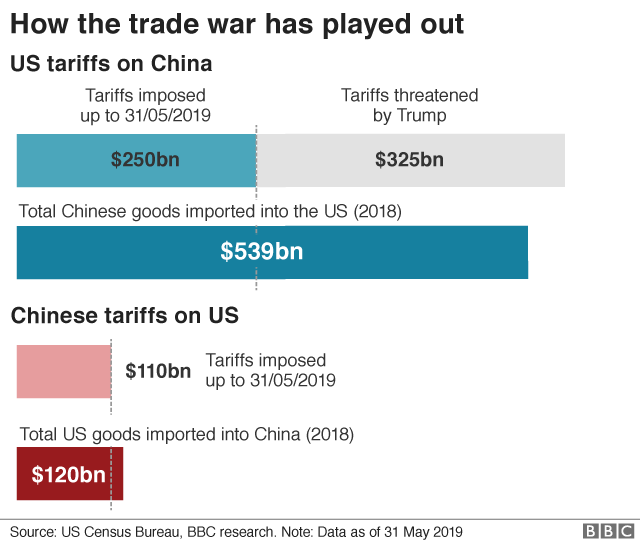

- China's tariff hikes on US goods come into force - BBC News

- बायडेन ने चीन के सामान पर लगाए ऊँचे टैरिफ, इसी बात पर करते थे ट्रम्प का ...

- US-China Tariff War: What are the Implications for the Healthcare Industry?

- US-China Tariff War and Apparel Sourcing: A Four-Year Review (updated ...

- New China Tariff Increases for Five Products - NNR Global Logistics

- Tariff moves between China and the US - Global Times

The Chinese government has stated that the new tariffs will affect around $60 billion worth of American goods, including agricultural products, chemicals, and cars. The tariffs will range from 5% to 25%, depending on the product. This move is seen as a significant escalation of the trade war, and it is likely to have far-reaching consequences for businesses and consumers on both sides of the Pacific.

Background to the Trade War

The trade war has already had significant consequences for businesses and consumers. American farmers have been particularly hard hit, as China has imposed tariffs on U.S. agricultural products such as soybeans and corn. The trade war has also led to increased prices for consumers, as companies pass on the cost of tariffs to their customers.

Impact on Global Economy

The trade war has also had a significant impact on the global supply chain. Many companies have been forced to rethink their supply chains, as tariffs have made it more expensive to import goods from China. This has led to increased investment in countries such as Vietnam and Indonesia, which are seen as alternative manufacturing hubs.

The decision by China to raise tariffs on American goods from June 1 is a significant escalation of the trade war between the U.S. and China. The trade war has already had significant consequences for businesses and consumers, and it is likely to have far-reaching implications for the global economy. As the trade war continues to escalate, it is essential for businesses and policymakers to work together to find a solution that promotes free and fair trade.For now, it seems that the trade war between the U.S. and China is set to continue, with no end in sight. As the world's two largest economies engage in a game of tit-for-tat, the rest of the world can only watch and wait, hoping that a resolution can be found before it's too late. The impact of the trade war will be felt for years to come, and it is essential that we take a proactive approach to mitigating its effects and promoting a more stable and predictable global trading environment.

Note: This article is for general information purposes only and is not intended to be taken as investment advice.