The technology sector has been abuzz with activity in recent days, and one stock that's been making waves is Broadcom Inc. (NASDAQ: AVGO). On [current date], Broadcom stock jumped significantly, leaving investors and market watchers scrambling to understand the reasons behind this sudden surge. In this article, we'll delve into the factors that contributed to this upward trend and explore what it might mean for investors.

A Brief Overview of Broadcom

Before diving into the reasons behind the stock's jump, it's essential to have a basic understanding of Broadcom and its operations. Broadcom is a leading designer, developer, and supplier of analog and digital semiconductor connectivity solutions. The company's products and services are used in a wide range of applications, including wireless communication, enterprise storage, and industrial automation.

Reasons Behind the Stock's Jump

Several factors have contributed to the recent surge in Broadcom stock. Here are some of the key reasons:

Strong Earnings Report: Broadcom recently released its quarterly earnings report, which exceeded analyst expectations. The company reported significant revenue growth, driven by strong demand for its semiconductor products. This positive earnings surprise has boosted investor confidence, leading to an increase in stock price.

Increased Demand for 5G Technology: The rollout of 5G technology is gaining momentum, and Broadcom is well-positioned to benefit from this trend. The company's semiconductor products are used in 5G infrastructure, and the increasing demand for these products has contributed to the stock's upward trend.

Expanding Product Portfolio: Broadcom has been expanding its product portfolio through strategic acquisitions and innovation. The company's recent acquisition of Symantec's enterprise security business has diversified its offerings and opened up new revenue streams.

What This Means for Investors

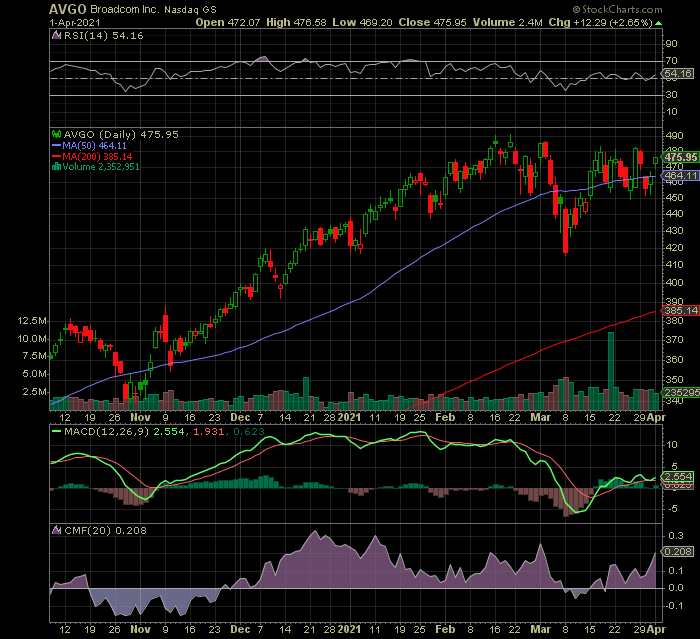

The recent surge in Broadcom stock is a positive sign for investors, but it's essential to keep things in perspective. While the company's strong earnings report and increasing demand for its products are encouraging, the technology sector is known for its volatility.

Investors should continue to monitor the company's performance and industry trends before making any investment decisions. With its strong product portfolio and growth prospects, Broadcom remains an attractive option for investors looking to capitalize on the growing demand for semiconductor products.

The recent jump in Broadcom stock is a testament to the company's strong fundamentals and growth prospects. While the technology sector can be unpredictable, Broadcom's diversified product portfolio and increasing demand for its products position it for long-term success. As the demand for 5G technology and semiconductor products continues to grow, investors may want to keep a close eye on Broadcom stock.

By understanding the factors that contribute to market trends and staying informed about company performance, investors can make more informed decisions and navigate the complexities of the stock market with confidence. Whether you're a seasoned investor or just starting out, staying up-to-date on the latest market news and trends is crucial for achieving your financial goals.